|

|

This below are explained the various types of securities which we find in the scripophily and to what they correspond. We shall speak successively about shares (action), bonds (obligations), about short term bonds (bons de caisse), about script, about warrant. We shall also speak of what consists such paper: a front page with or without stamps and coupons with or without heel. |

|

A share ('action' in French) is a paper issued by a company in representation of a fraction of its capital and to give evidence of a right to his shareholders. During the constitution of the company, the modalities of the issue are defined by the statuses: number of securities established so as to be able to distribute parts proportionally in the contributions of the diverse contributors, the peculiarities intended to organize the divisions of profits or rights, ...

Examples: share of enjoyment, profitable part, founder's part... The ' capital stock shares ' or ' ordinary shares ' often mention a nominal value. The terms 'share' and 'part' are synonymic. They can be to the bearer or nominatives, these mentioning the name of the owner registered in the register of the shareholders of the company.

Bearer shares can be passed on from hand to hand but more usually through banks.

Most of the shares are issued by Limited companies but we sometimes meet shares or parts of Cooperative Companies or some other specific types of companies.

|

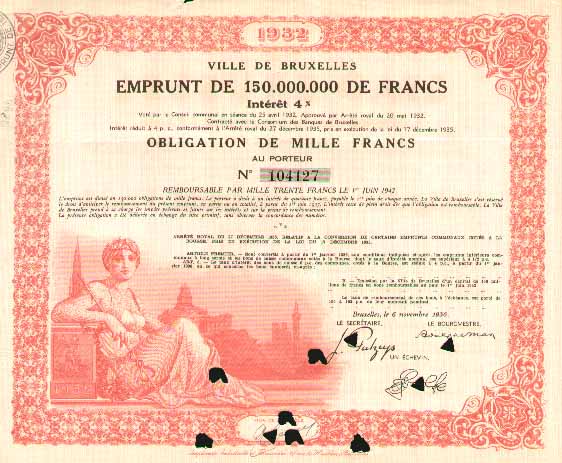

A bond ('obligation' in French) is a debt security of a value defined exactly, contrary to the share. It is the recognition of a loan made to the company. The modalities of the debenture loan are usually clearly written on the document:

date of issue, total amount of the loan, the interest rate, nominal value of the bond, duration,... Contrary to the shares, bonds can be issued by all the sorts of public authorities.

Opposite: bond issued by the city of Brussels for its loan of 1932.

|

|

|

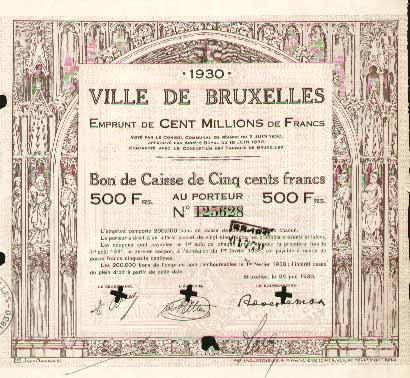

Ashort term bond ('bon de caisse' in French) is a paper comparable to a bond but of more reduced duration, generally maximum 5 years, and not enjoying the same privileges or the protections.

Opposite, short term bond issued by the city of Brussels for its loan of 1930

|

A script ('script' in French) is a word extracted from the professional jargon of the stock exchange and not appearing in most of the French dictionaries. Rather vague element which can indicate various things, for example, a right to a fraction of share or bond during an exchange.

Also, the right to get a balance on an operation of refund or exchange. The document which represents it is generally rather simple and is not of a particular interest in scripophily. |

Awarrant, originally, indicates a right of property on the goods in warehouse. This document allows, among others, to pawn these goods without moving them from their stocking place. In the stock market world, and in a rather recent way, this term indicates an option.

For example, the right to buy a predetermined share at a predefined price and during a restricted period. The diversion of the original definition can doubtless result from the English meaning which took the step on the French definition. |

Coupons : the bonds and shares are generally accompanied with a sheet of coupons intended to collect the dividends of companies or the interests of loan. As these are formally fixed, the coupons of bonds mention, besides the number, the date of collection and the amount to receive.

The sheet of coupons often contains a"heel"which is a different coupon and often a little bigger.It is normally of use to the attribution of a new sheet of coupons when the first one is exhausted.

As it is normal, in the life of these papers, that the coupons are cut it deprives nothing of their value of collection. It is however preferable that they are cut without damaging the front page. The only coupons have no value of collection.

|

Front page : this term indicates the sheet of the title strictly speaking, first side and reverse but with the exception of the sheet of coupons. |

Stamps : often the bonds and shares are decked out by even unsightly or important stamps. They were normally affixed in the case of modification to the statuses or to the definition of the company or type of certificate. A "preference share" can become, for example "ordinary share".

When you have the choice, it is better to keep only the least dirtied ones, with the least stamps.

Before the war, securities were officially sealed to give evidence of a receipt of tax. These stamps can clarify the countries in which the securities circulated.

|

|